The Outlook examines the structure and dynamics of the economy from multiple perspectives using advanced modelling and data-driven analysis.

How Azerbaijan Can Escape the Middle-Income Trap

Last Exit Before the Bridge: Innovate Azerbaijan! (Non-Technical Summary)

Challenges

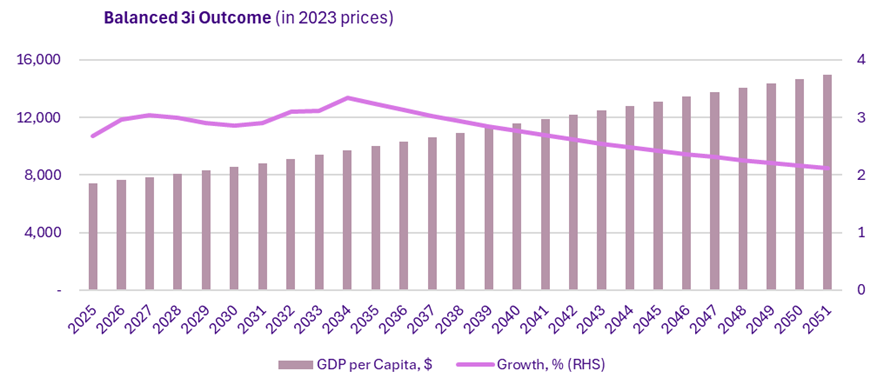

Azerbaijan is expected to be trapped in the middle-income trap for over 100 years before reaching high-income status ($14,005 per capita gross national income (GNI/capita)), according to the World Bank (2025), while neighbors escape faster: Armenia (19 yrs), Türkiye (26 yrs), Kazakhstan (29 yrs), and Georgia (30 yrs).

The situation can be justified by The World Bank’s 3i Framework (Investment → Infusion → Innovation) (2024) that defines the sequential path from low- to high-income.

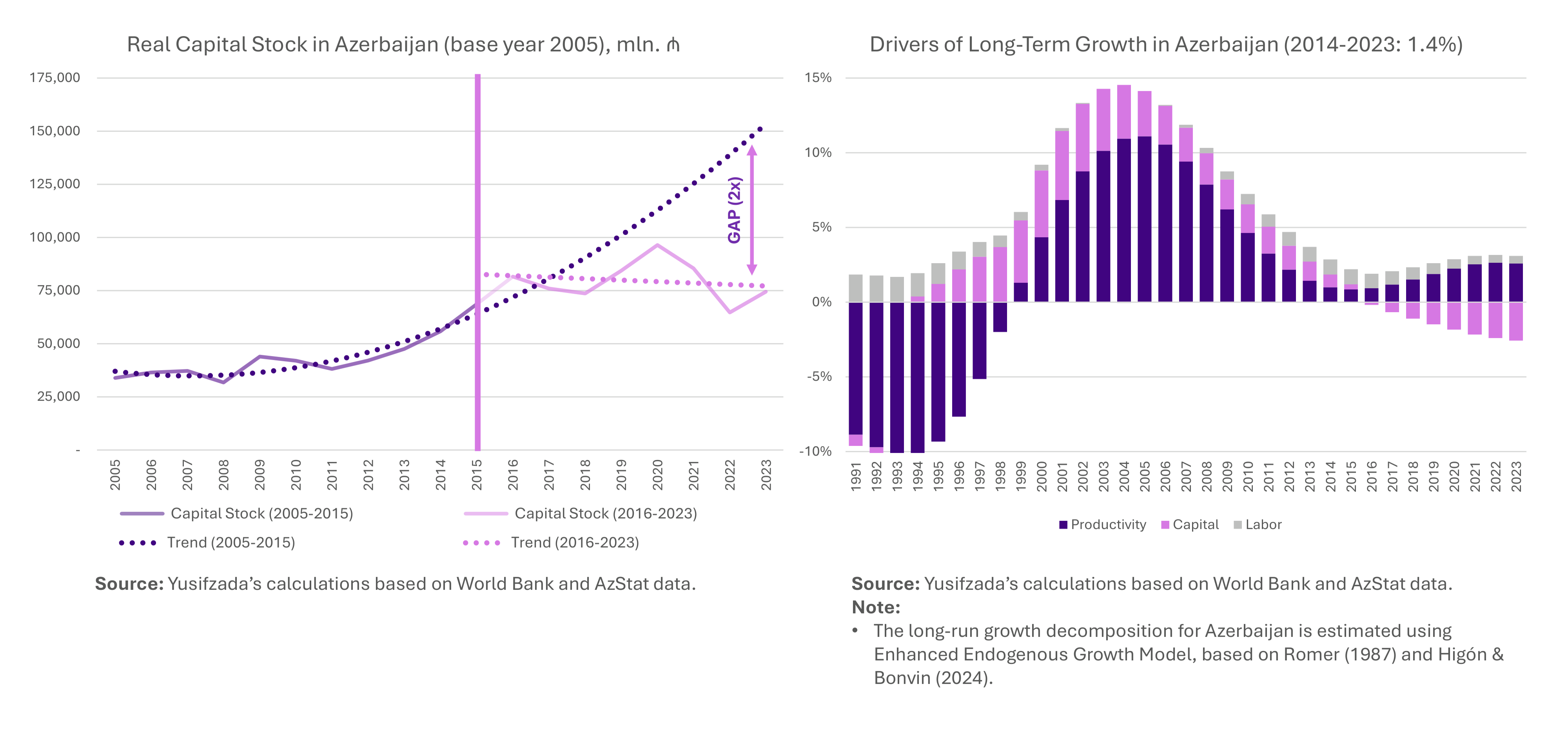

- 1i (Investment): Azerbaijan cannot sustain capital stock — growth foundation is eroding:

- Declining capital stock since 2016 → fails even the 1i (investment) phase.

- 2i (Infusion): High digital imports, but weak domestic adoption — infusion stage not triggered:

- The estimated digital economy size is only 7.8% (25.1% in the US).

- 3i (Innovation): Near-zero VC, shrinking high-tech exports — innovation phase absent:

- VC per labor is 0.44$ (748.66$ in the US); high-tech exports fell from 4.2% (2023) to 2.9% (2024) (24.32% in the US).

Methodological Explanation for Solution

We use an enhanced endogenous growth model with multiplier effects estimated for Azerbaijan and validated by global studies:

- ICT capital investment multiplier = 1.8 × Traditional investment multiplier

- Digitalization (adoption) multiplier = 2.6 × Traditional investment multiplier

- Innovation (R&D + VC) multiplier = 3.7 × Traditional investment multiplier

The transition to a high-income level for Azerbaijan in 15 years is simulated through five different scenarios under the 3i methodology to obtain the optimal solution:

| Investment Scenarios | Investment Needed | Feasibility |

| 1. Current trend | – | Impossible |

| 2. Traditional sectors | 285B AZN | Impossible: Azerbaijan does not have 285 billion manat |

| 3. ICT sector | 143B AZN | Unabsorbable: ICT sector, with a capital stock of 4.5 billion manat, cannot absorb 143 billion manat |

| 4. Digitalization | 95B AZN | High strain on reserves & weakly absorbable |

| 5. Digital + Innovation | 22B initial + 3B/yr | Feasible |

Solution Path

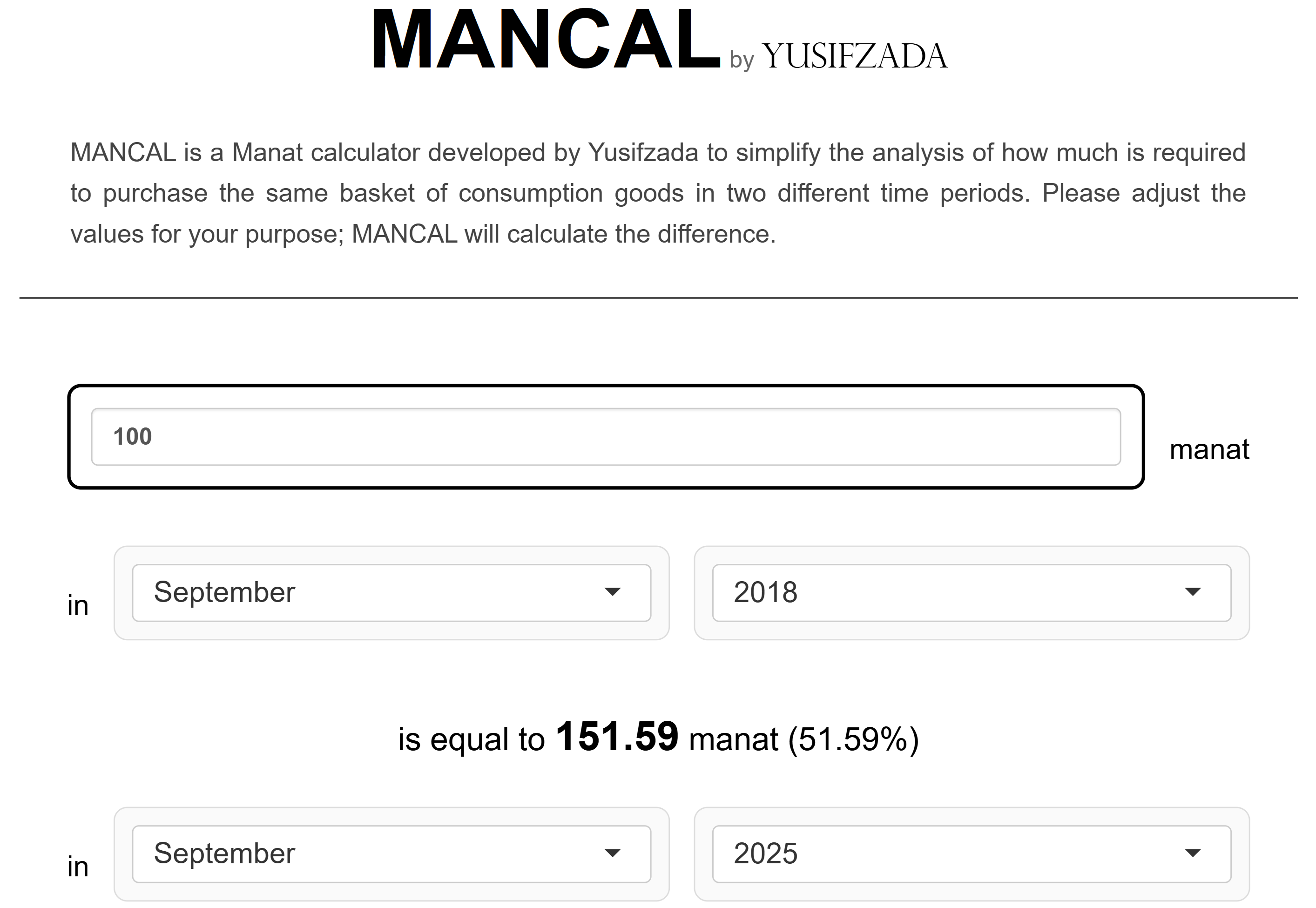

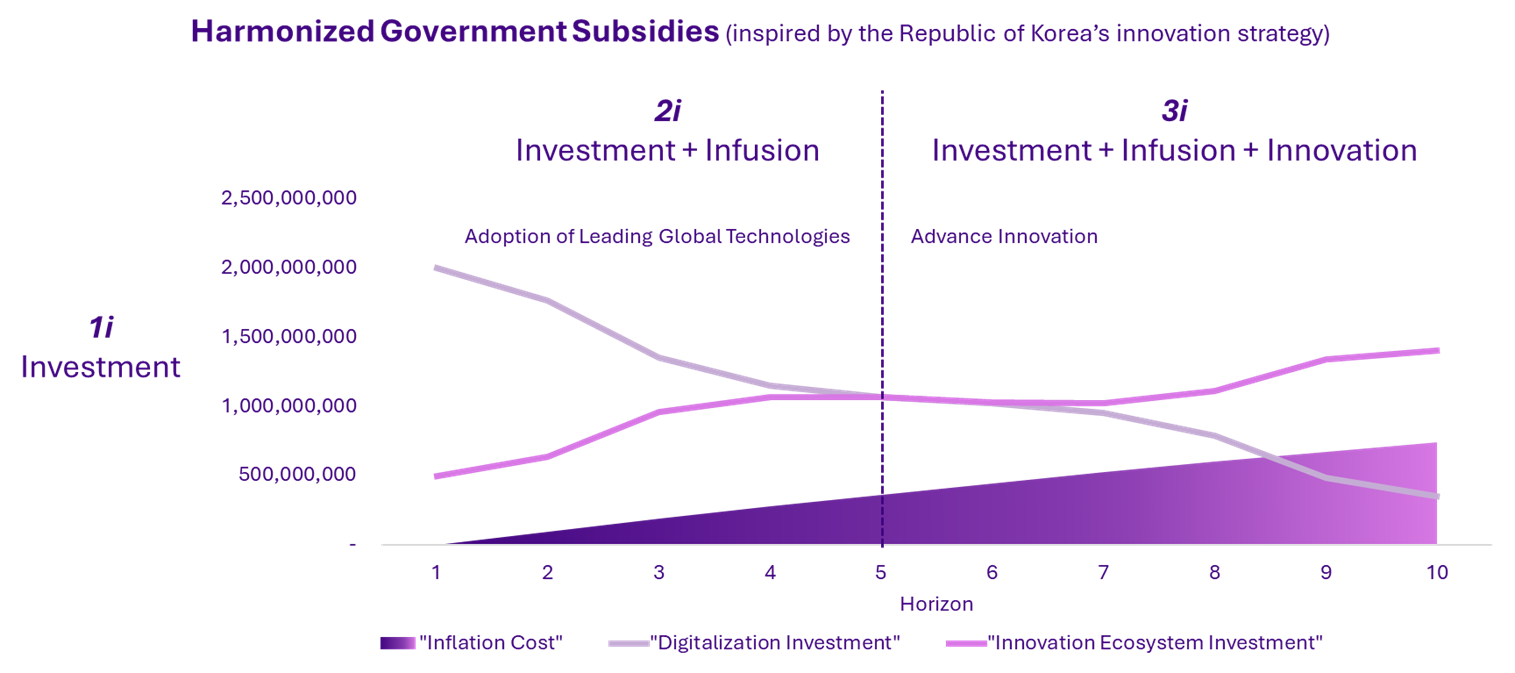

Although scenario 5 appears to be the most feasible solution, a 25 billion manat investment could still strain strategic reserves if fully funded by the government. An optimal approach may involve balancing the initial investment with the timeline to reach high-income status. For example, investing 2.5 billion manat annually (for 10 consecutive years), as shown in the figure below, could transform Azerbaijan into a high-income country within 28 years. However, delays introduce inflation costs, reducing the real value of the total 25 billion manat investment to approximately 21 billion manat.

Results

| Outcome (in 15–28 years) | Result |

| High-income status | Achieved |

| National income | Doubles |

| Digital economy size | ~14.4% of GDP |

| R&D/GDP | Doubles (~0.41%) |

| VC per labor | ~256.2$ |

| Cost recovery | Full via tax in 7 years |

| Investment efficiency | 91% less costly than the traditional path |

Conclusion

“Innovation rooted in digitalization is the last exit for Azerbaijan if we do not want to lag behind our neighbors’ development level.”

14.11.2025

Decomposing Long-Run Growth in Azerbaijan

It seems that real capital stock — eroded by depreciation and inflation exceeding investment — and labor have reached their limits in driving growth in Azerbaijan. This phenomenon highlights that the economy’s growth potential is constrained, as capital continues to diminish and productivity has become stagnant. In the coming years, if the declining capital trend is not reversed or a productivity boost cannot be achieved, the economy may become structurally stagnant.

01.10.2025