The Outlook examines the structure and dynamics of economies—especially emerging ones—from multiple perspectives, using advanced modelling and data-driven analysis.

CLIMATE CONDITION INDEX (CCI)

Global Inflation Dynamics in the Face of Climate Change: A Unified Approach Using the Climate Condition Index (CCI)

To access the full article, please visit the Middle East Technical University website.

This research note introduces a structured framework for integrating climate change into inflation modeling. While the link between climate and agriculture is widely recognized, this study formally incorporates climate variables into the structural equations used to analyze global inflation—a connection often omitted from standard central banking models.

A Unified Measurement: The Climate Condition Index (CCI)

A primary challenge in climate-based economic modeling is “dimensionality”—the difficulty of incorporating multiple climate variables into inflation formulas without making them overly complex. To address this, the paper develops the Climate Condition Index (CCI).

- Variables: The CCI consolidates five critical environmental indicators: temperature, precipitation, cloud coverage, wet day frequency, and vapor pressure.

- Methodology: Instead of applying a “one-size-fits-all” weight to these variables, the index uses a Vector Error Correction Model (VECM). This allows the index to weight each variable based on its specific long-term historical relationship with a country’s price levels.

- Scope: The index was constructed for 39 different countries using data from 1950 to 2021, accounting for the fact that a climate shift in one region may have a vastly different economic impact than in another.

The Transmission Channels to Inflation

The research identifies three main pathways through which climate shifts influence the economy:

- Productivity Shocks: Extreme weather events can reduce yields and output, increasing real marginal costs for firms, which leads to upward pressure on prices.

- Cost Sensitivity: When climate shocks hit an entire sector simultaneously, firms may become more sensitive to cost changes, expecting competitors to adjust prices in unison.

- Markup Adjustments: In the face of supply-side disruptions caused by climate conditions, firms may adjust their profit markups to hedge against volatility, further influencing inflation dynamics.

Key Findings

The study reveals a significant and uneven global impact of climate change on price stability:

- Broad Impact: Approximately 77% of the countries studied (30 out of 39) are significantly affected by climate variables.

- Direction of Pressure: 27 countries show significant inflationary responses to climate impulses, whereas only 3 countries experienced a deflationary or “beneficial” effect.

- Income Disparity: The negative impact on inflation is nearly four times stronger in emerging (middle-income) countries compared to advanced (high-income) economies.

Policy Implications

By providing a singular, robust tool to monitor climate-induced price risks, this research offers a practical framework for central banks. Integrating the CCI into the New Keynesian Phillips Curve allows policymakers to better account for “greenflation” risks and improves the accuracy of inflation forecasting in an increasingly volatile environment.

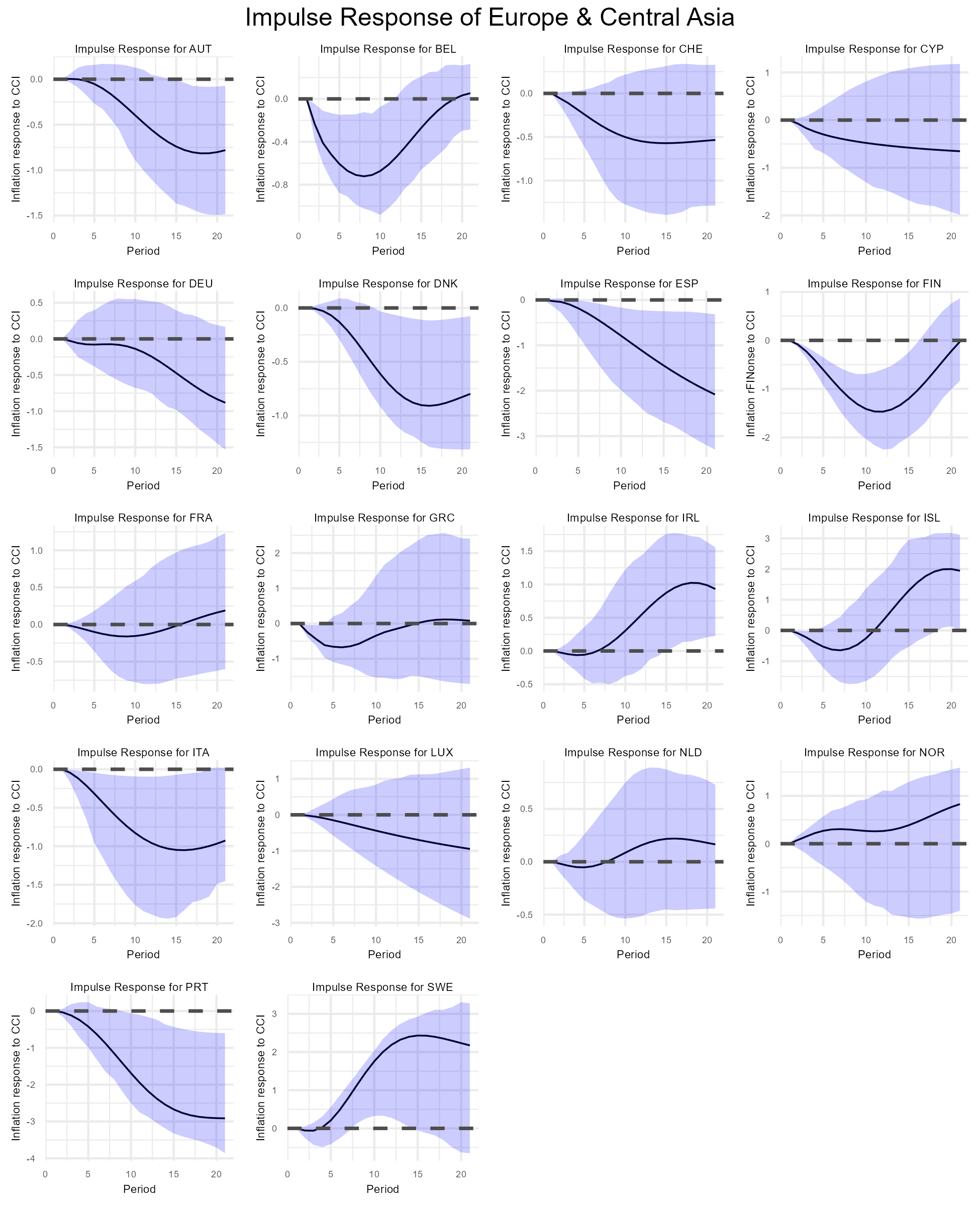

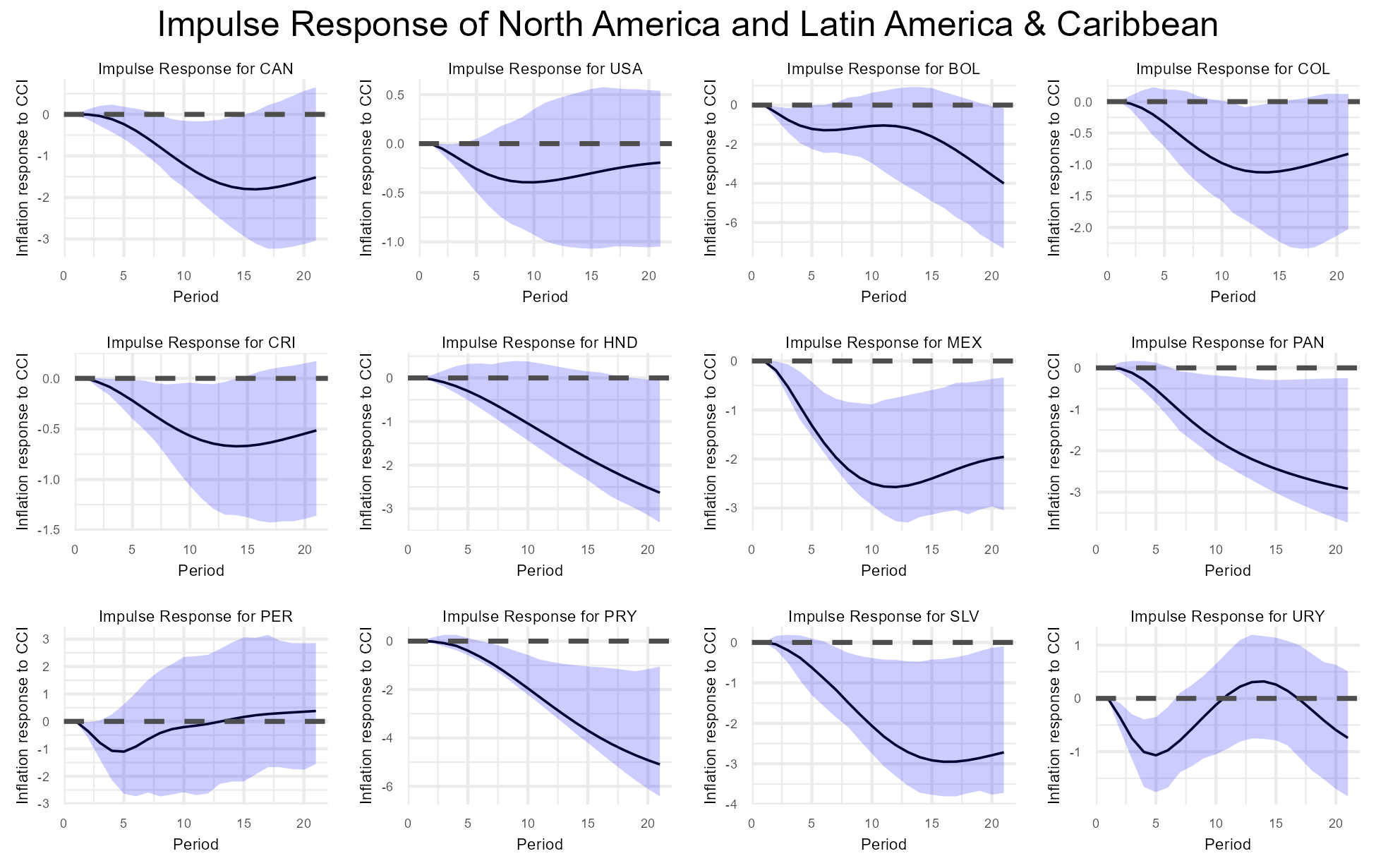

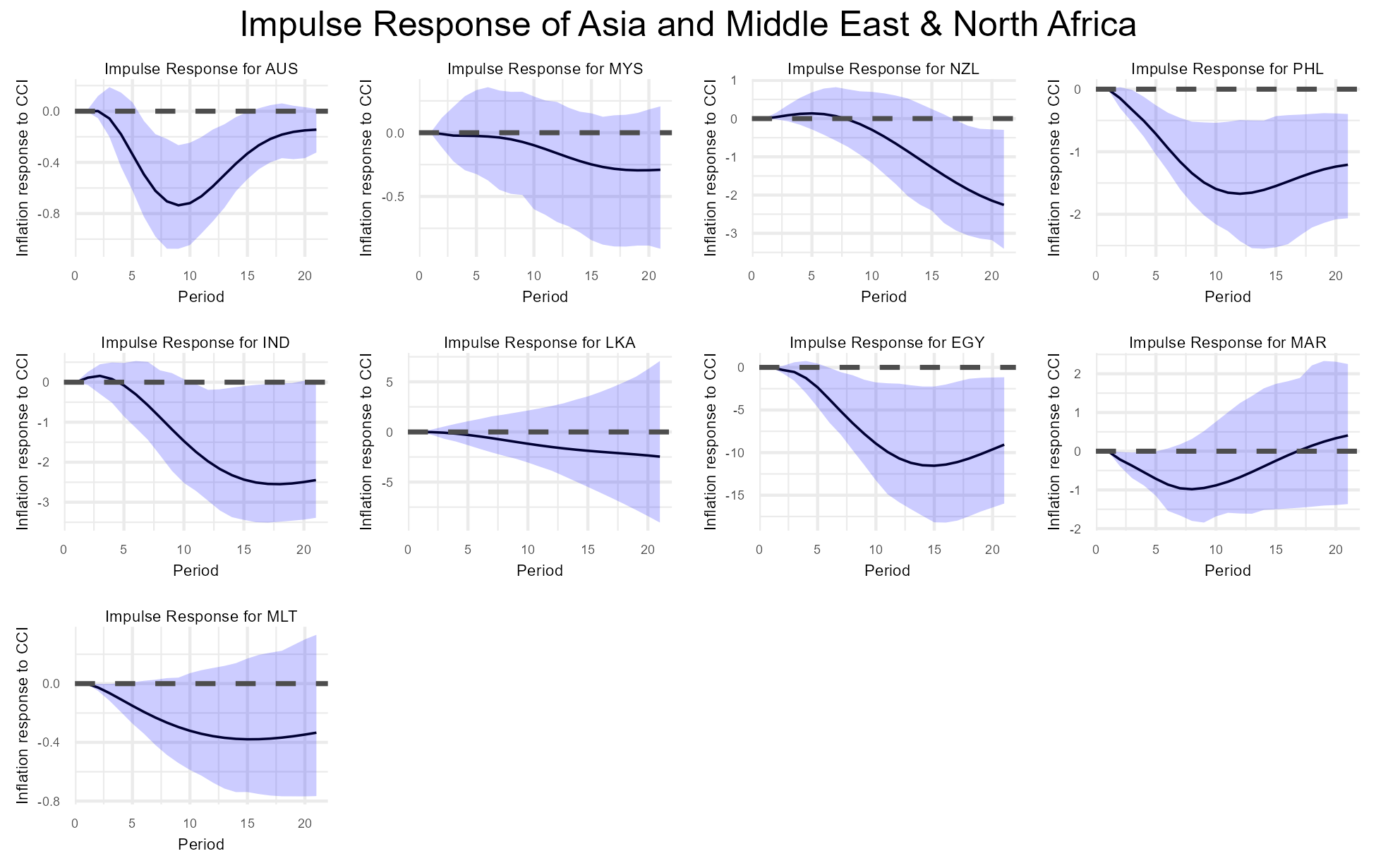

Country-specific impulse responses

13.1.2026

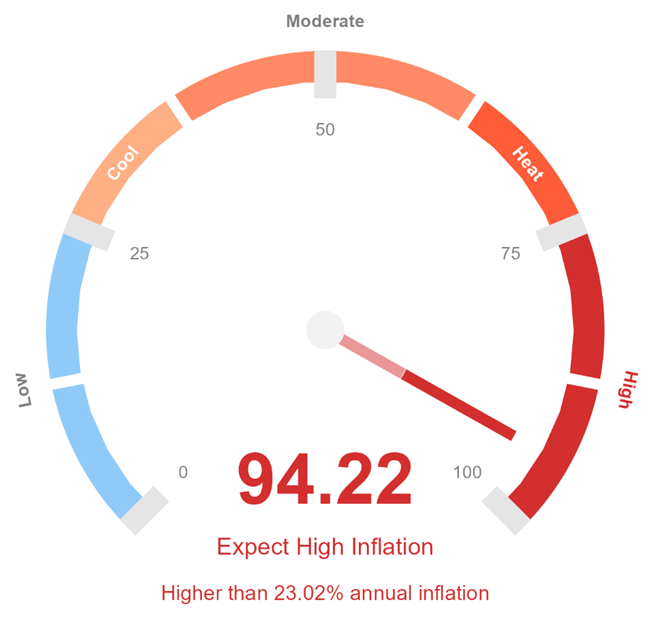

INFLATIONMETER

Inflationmeter — a Tool Generated Based on A Composite Approach to Nonlinear Inflation Dynamics in BRICS Countries and Türkiye

Authors of the Research Paper: Tural Yusifzada; Hasan Cömert; Vugar Ahmadov

To access the full article, please visit the Bank of Finland website.

Inflationmeter is an interactive visualization tool based on the research paper titled “A Composite Approach to Nonlinear Inflation Dynamics in BRICS Countries and Türkiye,” which explores why inflation behaves unpredictably in emerging economies such as Brazil, Russia, India, China, South Africa, and Türkiye.

The tool illustrates how inflation doesn’t always follow straightforward patterns—instead, it reacts differently depending on whether it’s in a “high-inflation” phase (where prices spike aggressively) or a “low-inflation” phase (where changes are more cautious), and how big economic shocks (like currency drops or cost increases) amplify these shifts. This provides a clear advantage over traditional forecasting tools, which often fail to capture these nonlinear dynamics and therefore produce large prediction errors, including underestimating the post-pandemic surge in prices.

Novel Methodology

The paper introduces a fresh, two-step “composite” method that’s grounded in real-world economic theory but uses smart econometric tools to spot and predict inflation patterns:

Step 1: Identifying Inflation “Regimes”: The paper uses a Hidden Markov Model (HMM), an algorithm that detects hidden shifts in the inflation structure, combined with Monte Carlo simulations (randomized tests to assess reliability). This approach endogenously identifies high- and low-inflation thresholds for each country by simulating how price-setting behaviors—such as markups and cost sensitivities—change structurally across different environments, based on historical data from the 1990s to 2024. Unlike older methods that rely on arbitrary cutoffs (e.g., “inflation above X% hurts growth”), this framework identifies a high-inflation regime when the constant term and elasticities are elevated, and a low-inflation regime when the constant term and elasticities are lower relative to a moderate regime.

Step 2: Predicting Shifts with Nonlinear Analysis: The paper applies an ordered probit model, which calculates probabilities of regime changes while accounting for two key nonlinearities: (1) shock magnitude (big disruptions hit harder than small ones) and (2) regime differences (inflation acts tame in low phases but wild in high ones). Key drivers analyzed include unit labor costs, exchange rates, and global inflation. This setup turns the model into an “early-warning” system for central banks.

Key Findings

- Inflation shows asymmetric responses: Small shocks fade quickly, but large ones (e.g., sharp currency falls) trigger outsized, lasting price hikes.

- Pricing behaviors flip between regimes: In low-inflation times, firms adjust prices slowly and carefully; in high-inflation times, adjustments become synchronized and aggressive, making inflation stickier.

- The model nails historical patterns in BRICS and Türkiye, revealing how post-2020 surges were driven by these nonlinear dynamics.

- It accurately detects regime shifts, like the pandemic-era jumps, and explains why standard models failed (e.g., they ignore how expectations and shocks interact nonlinearly).

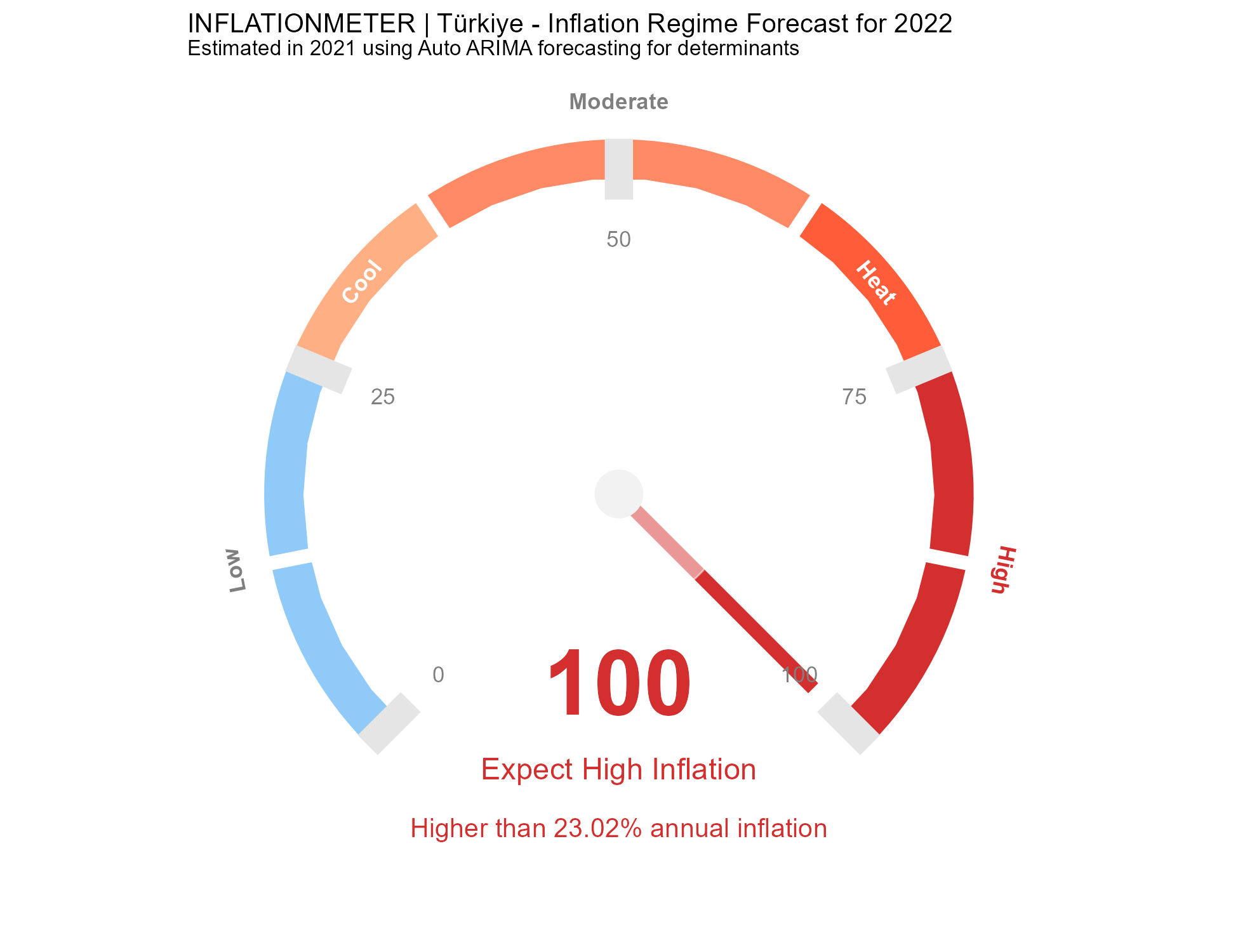

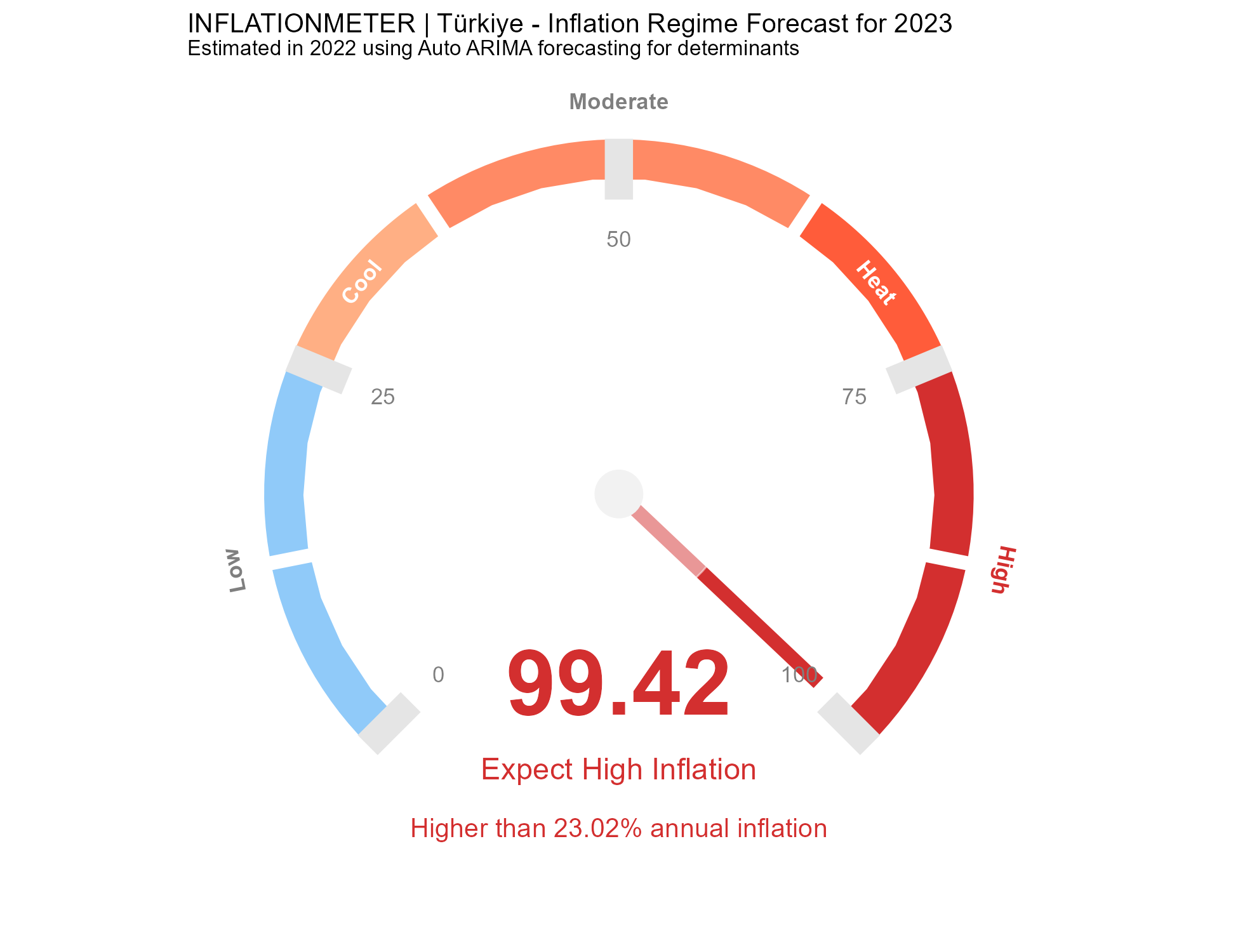

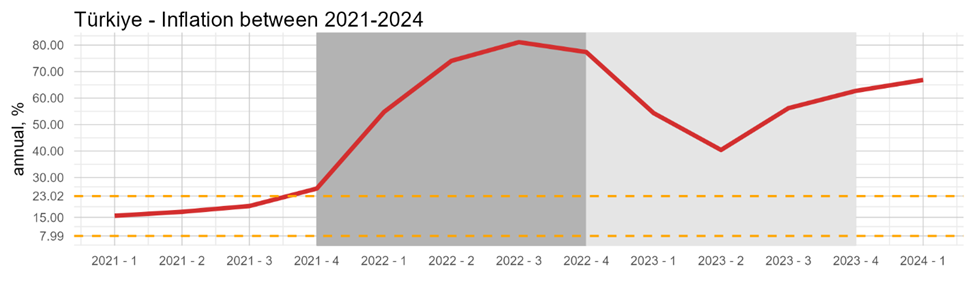

How Powerful It Is

This method is remarkably effective, achieving over 90% accuracy in explaining and predicting past inflation regimes based on historical data—far better than many traditional tools. For out-of-sample tests (predicting unseen future data), it shines in the post-pandemic era, outperforming forecasts from international financial institutions. Even without incorporating actual future data on drivers such as exchange rates, it correctly anticipates regime shifts in five out of six countries for 2022 and 2023, one year in advance (the exception is South Africa). Overall, it’s a powerful, practical tool for policymakers in volatile economies, helping spot risks early and avoid credibility-damaging surprises.

Out-of-Sample Forecasts

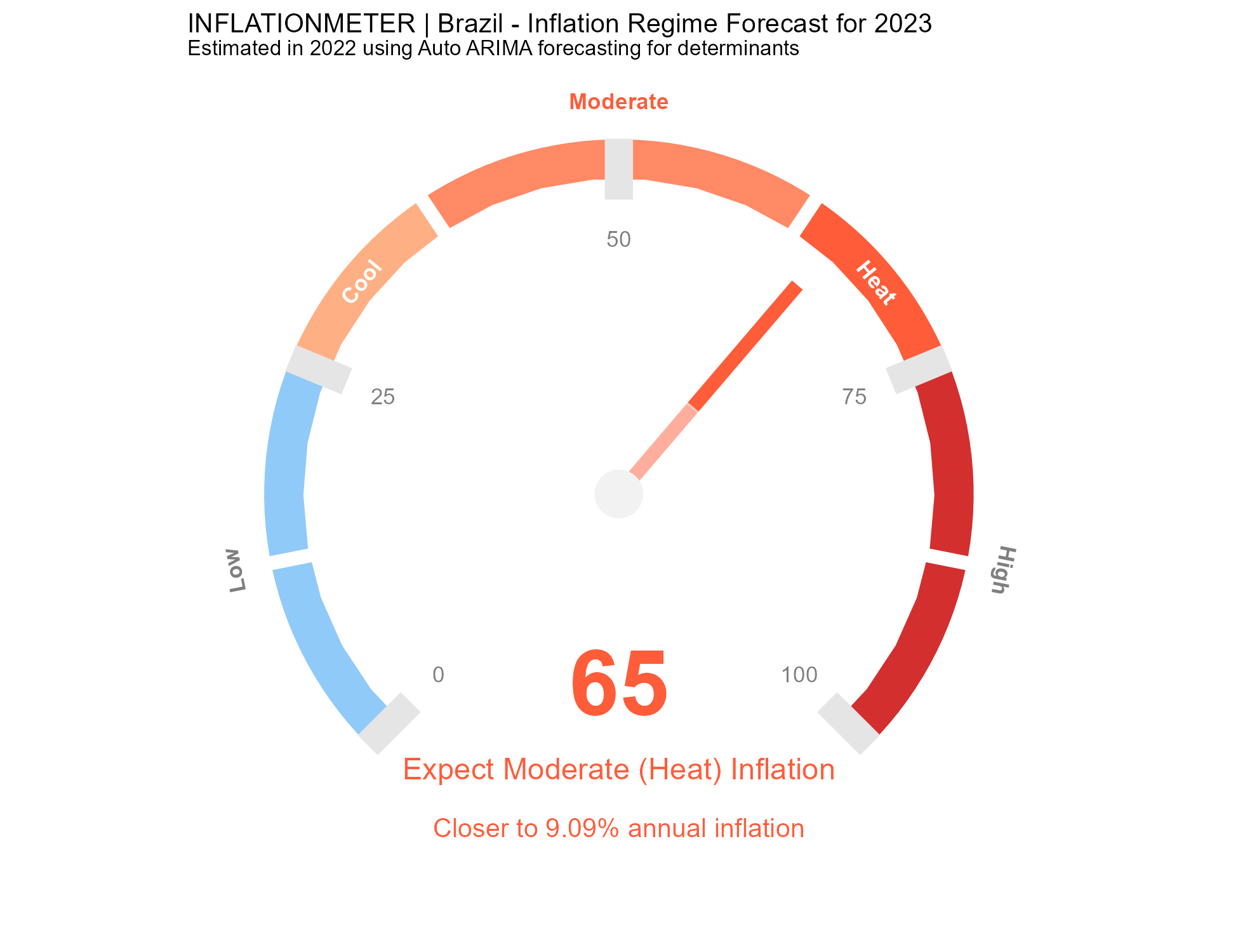

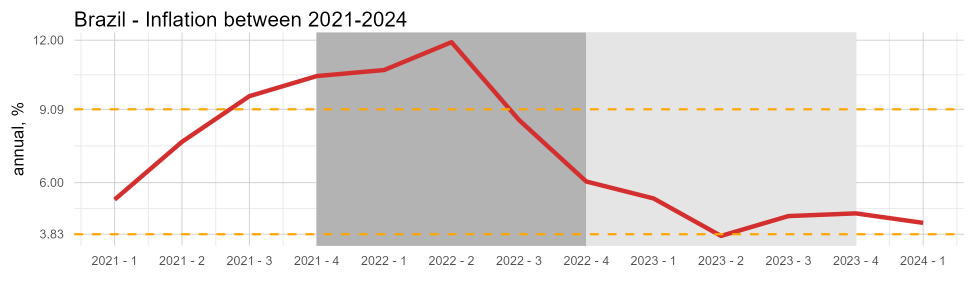

BRAZIL

Brazil: The model accurately predicts the persistence of high inflation in 2022 and predicts a transition to moderate inflation in 2023 as new data signal a forthcoming moderation. The IMF forecast for Brazil’s annual average inflation in 2022 was 5.3% (moderate inflation) according to its October 2021 outlook (International Monetary Fund, 2021).

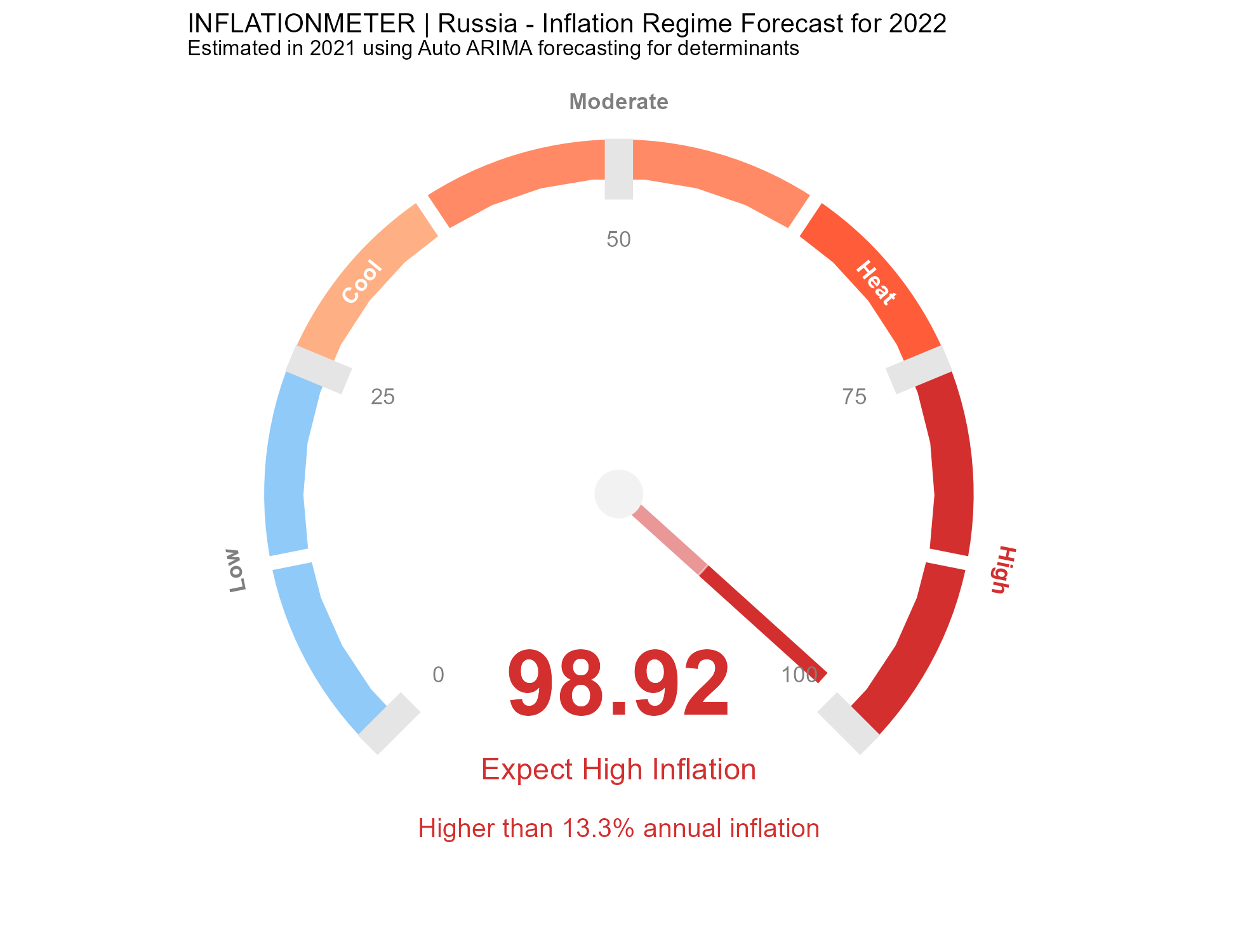

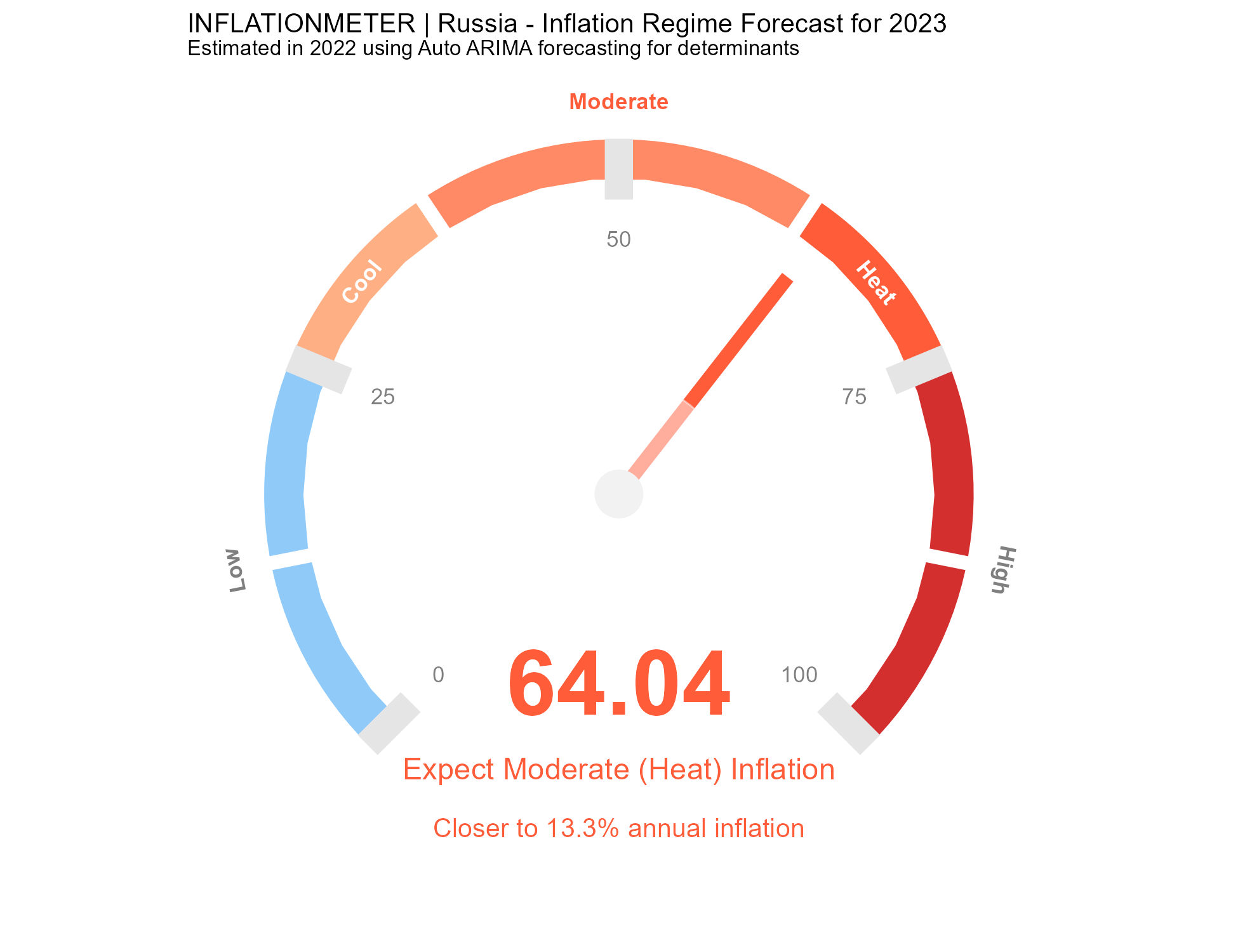

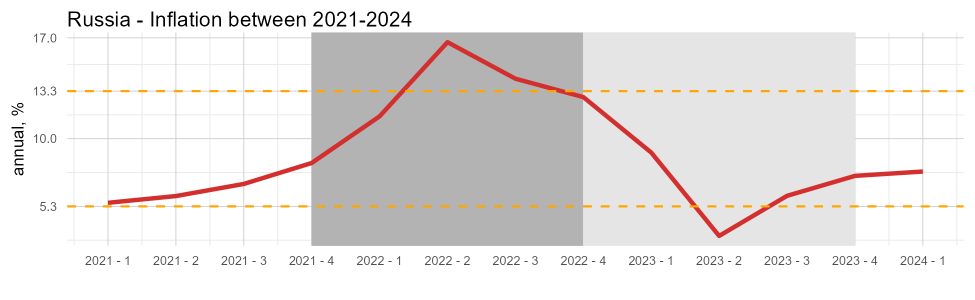

RUSSIA

Russia: Due to determinant dynamics in the last two quarters of 2021, the model successfully predicts a regime switch to high inflation in 2022. After training with the 2022 data, the model accurately anticipates a potential shift from moderate to low in early 2023, while returning to a moderate level at the end of 2023. The IMF forecast for Russian inflation in 2022 was 4.8% (low inflation) in its October 2021 outlook.

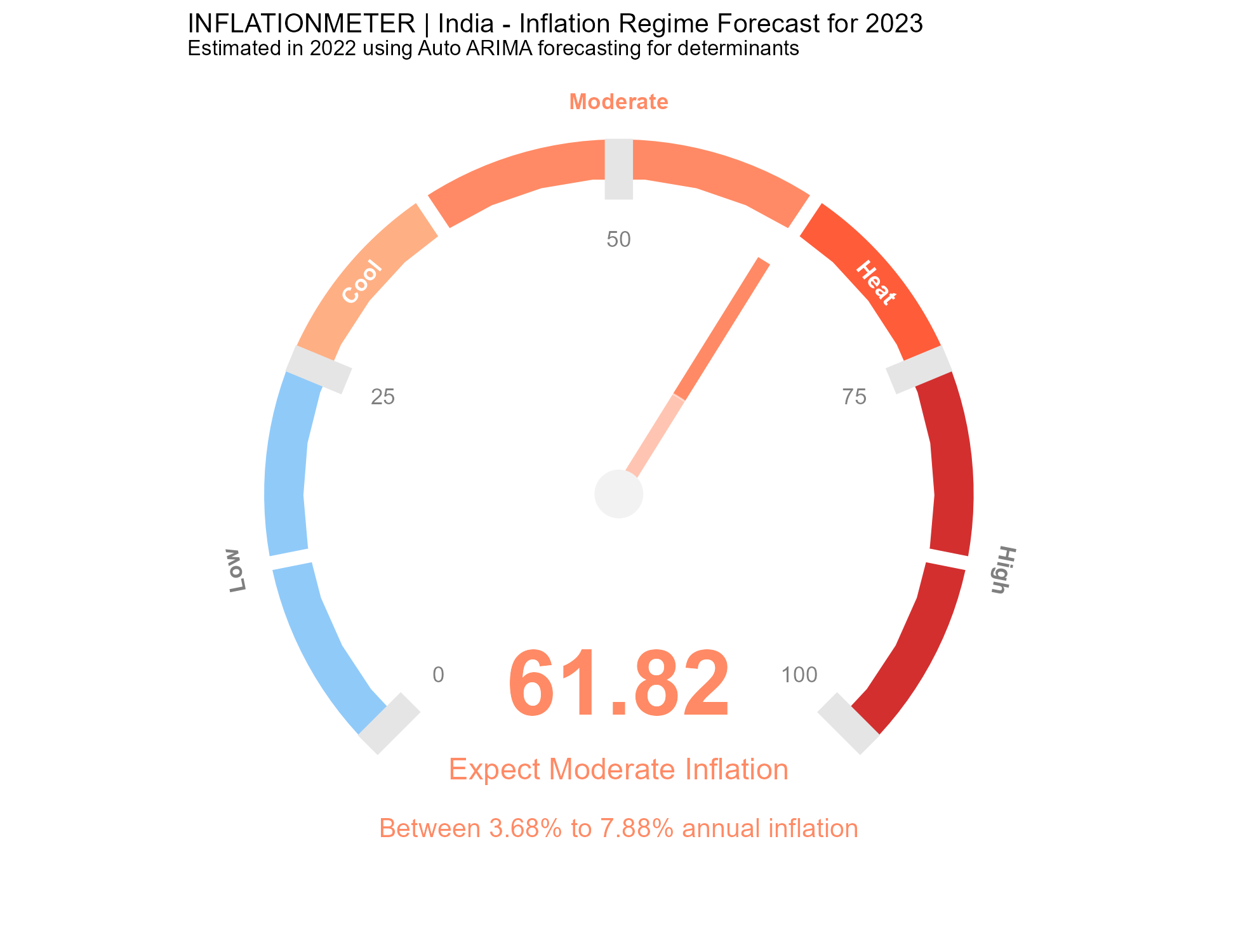

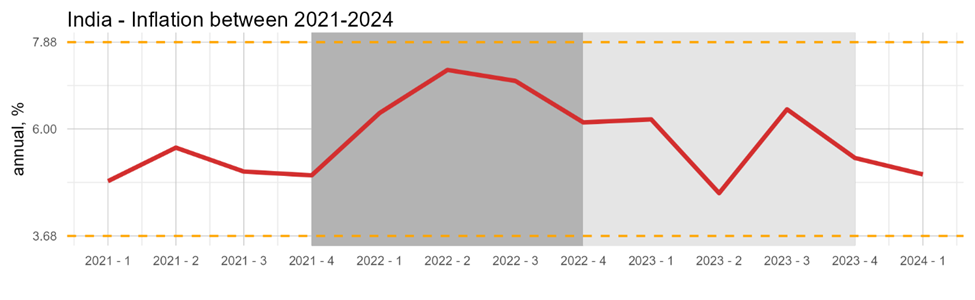

INDIA

India: No regime switch occurred in India; the model does not predict a switch.

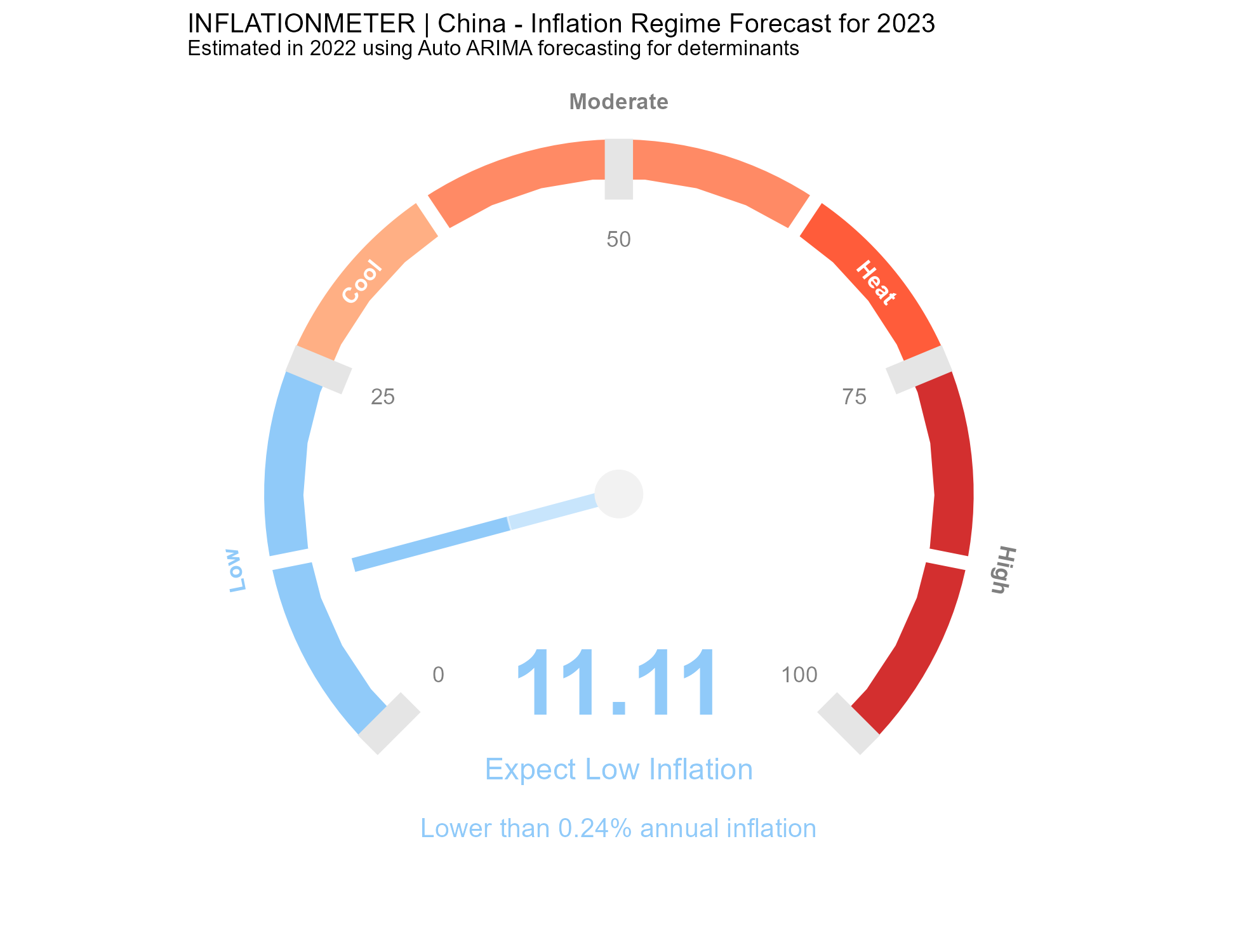

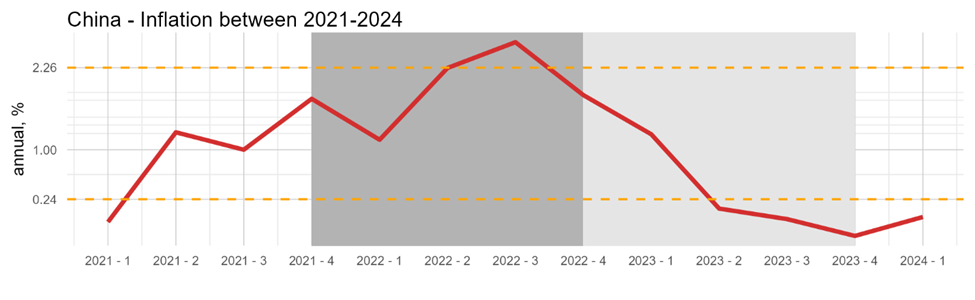

CHINA

China: The model correctly predicts a shift from moderate to high inflation in 2022 and from moderate to low in 2023. The IMF’s 2022 inflation forecast for China, published in its October 2021 report, was 1.8% (moderate inflation).

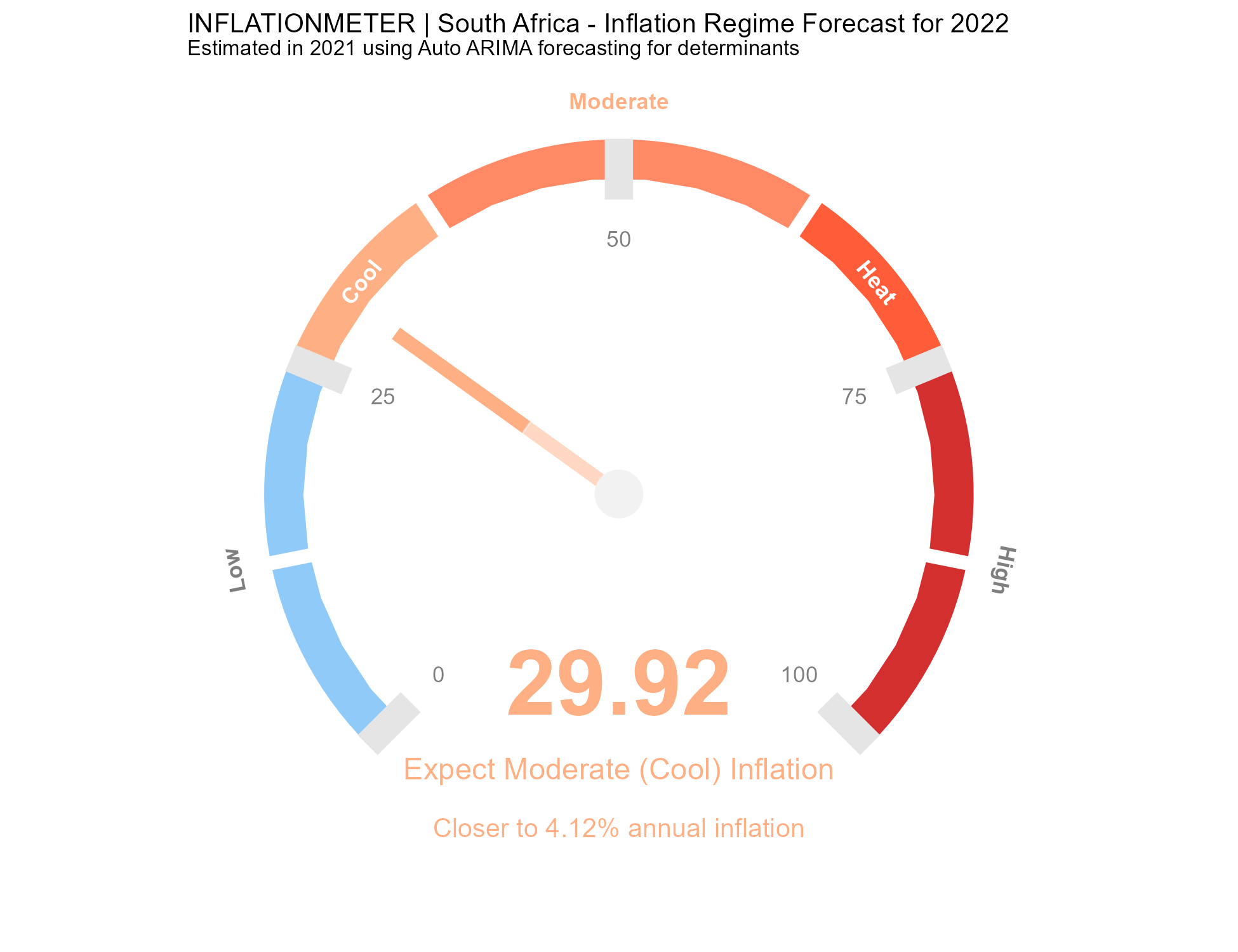

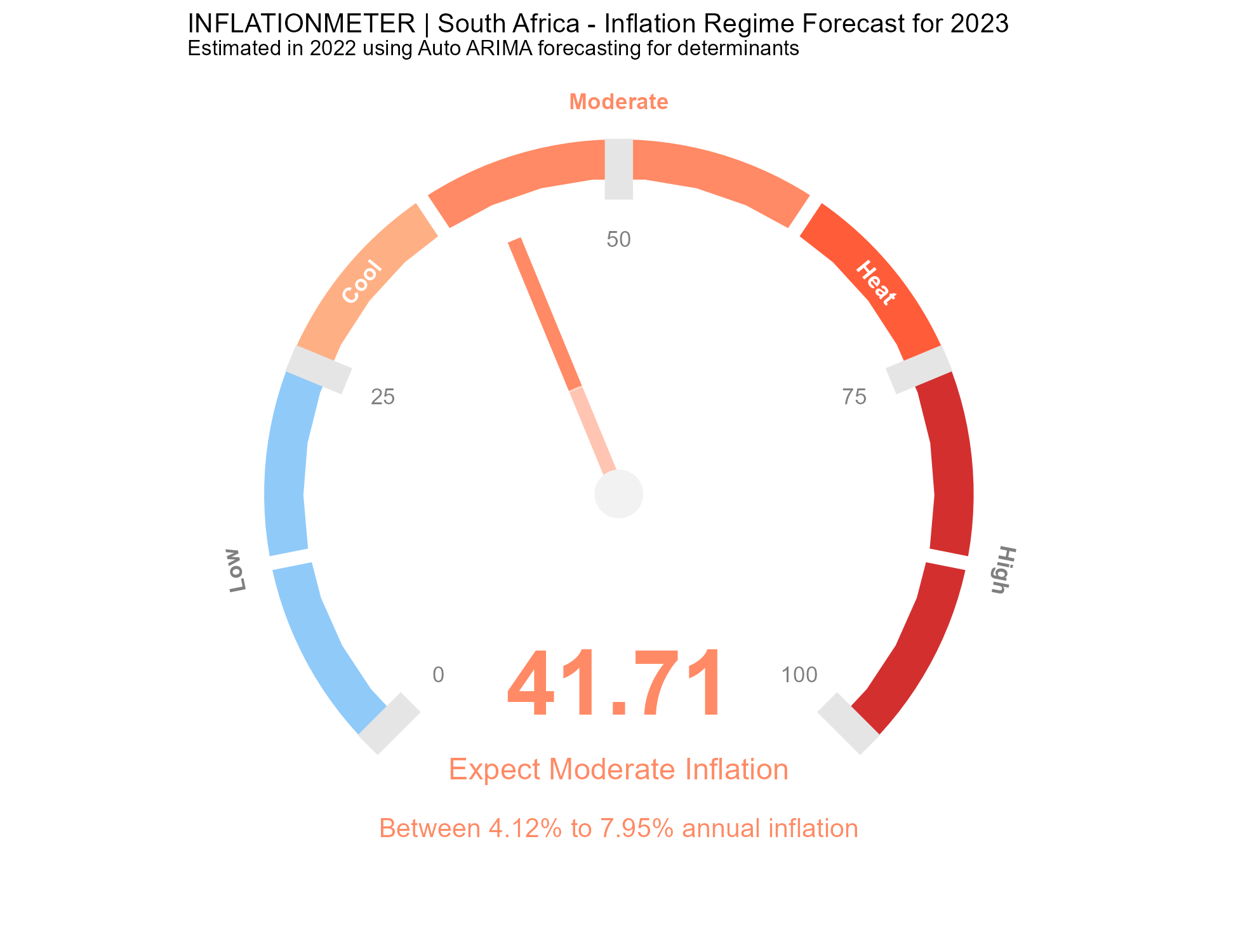

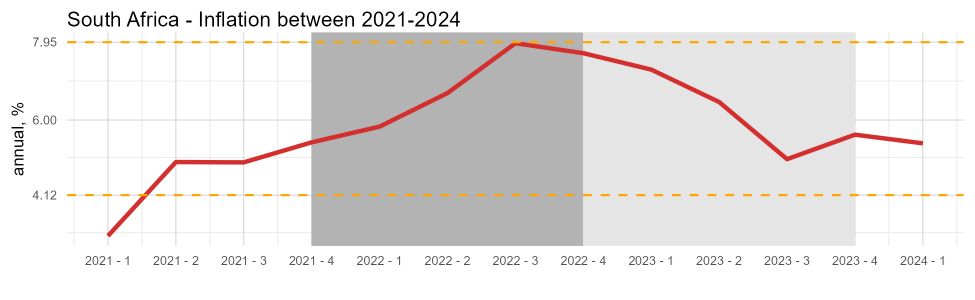

SOUTH AFRICA

South Africa: While on average inflation regime forecasts are accurate, the initial regime estimates for South Africa are less precise, largely because the ARIMA model mispredicts the dynamics of FX depreciation. In 2021, the South African rand appreciated, which led ARIMA to underestimate the likelihood of significant depreciations (reaching 20%) in subsequent quarters. Since FX is the most influential determinant of regime switches, this misprediction affected the accuracy of the probit model. However, as the rolling sample extended and the model observed the actual depreciation of the rand, its regime predictions corrected themselves. The IMF forecast for inflation in South Africa in 2022 was 4.5%, which was closer to the actual inflation outcome.

TÜRKİYE

Türkiye: The model’s predictions are entirely accurate. The IMF forecast for Türkiye was 15.4% (moderate inflation) for 2022.

28.11.2025